What Homebuyers Need To Know About Credit Scores

Some Highlights

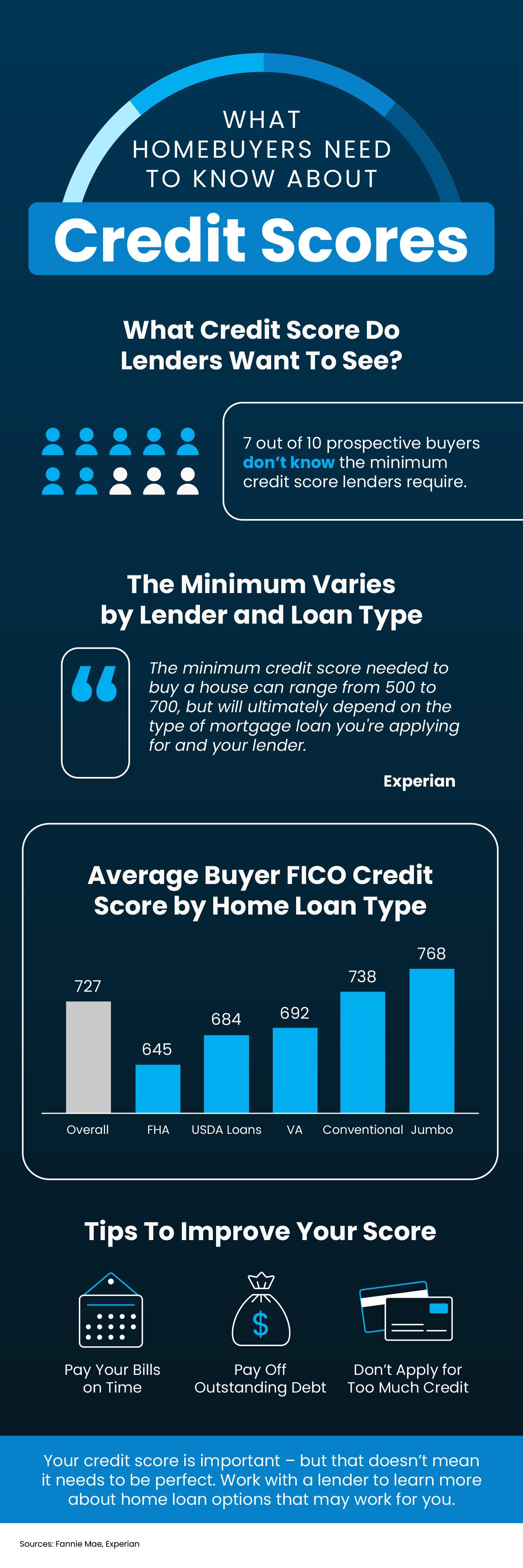

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

Categories

Recent Posts

The Rooms That Matter Most When You Sell

Understanding Today’s Mortgage Rates: Is 3% Coming Back?

Why Buying Real Estate Is Still the Best Long-Term Investment

Newly Built Homes May Be Less Expensive Than You Think

Home Projects That Add the Most Value

Is It Better To Rent or Buy a Home?

The Secret To Selling Your House in Today’s Market

Many Veterans Don’t Know about This VA Home Loan Benefit

Common Real Estate Terms Explained

Real Estate Is Voted the Best Long-Term Investment 12 Years in a Row

"Dedicated to delivering exceptional client experiences, I combine expertise, professionalism, and a client-focused approach to achieve outstanding results in real estate."